Pan Card Aadhaar Card Linking - Last Date To Link Aadhaar Card And Pan On March 31 Details Here Hindustan Times - Between the justify time, if you do not do.

Pan Card Aadhaar Card Linking - Last Date To Link Aadhaar Card And Pan On March 31 Details Here Hindustan Times - Between the justify time, if you do not do.. Deadline for linking pan card and aadhaar card is 31 march 2021. How to check pan card link with aadhar card or not. People can get their pan and. Between the justify time, if you do not do. Those who file income tax return by using their aadhar card will be allocated a new pan by their tax authorities.

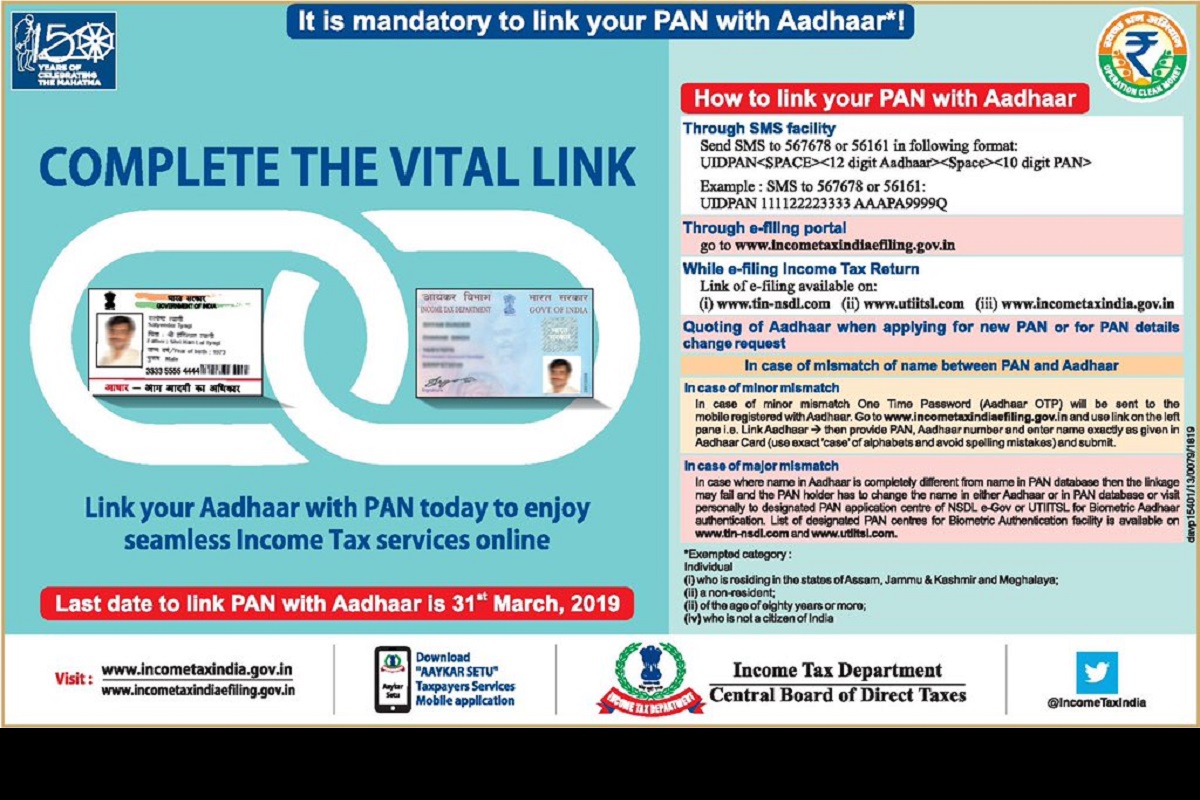

This card links all transactions that attract taxes under a single source. How to link aadhaar with pan card through sms. Here is the online steps to link aadhaar card with pan card and sms process to link pan card to aadhaar. Open an instant bank account with aadhar pan linking. A guide with screenshots on how to link aadhar to pan card/ permanent account number.

The last date for linking aadhaar with pan.

The income tax department has extended the last date to link aadhar card with pan card to 31st december 2019. If you go directly to the pf office and submit the 15g pf form, they will manually clear it. This law was also upheld by the supreme court and pan aadhar link has become essential. This makes it very convenient for the govt to stay track of those transactions. How to change mobile number in aadhar card. Since a pan card is necessary, linking it to your. Enter all the personal details and select the benefit type from the options menu and select ration. Compulsory to provide both aadhaar & pan crad how to link aadhaar number to pan card ? The last date for linking aadhaar with pan. If you do not link your pan with your aadhaar, then your pan will become inoperative from april 1, 2021. In case of any errors or mismatch, the pan shall not get linked with aadhaar and the required changes can be made online. Once uidai verifies the data, the linking gets confirmed. The pan linking process with aadhar card only been done, when details of both documents match with each other.

Link aadhaar card with pan card online through income tax department of india portal. In such cases, you have to correct the details in one document aadhar card or pan card. Linking of pan card with aadhaar card is permitted by the supreme court while reading out its judgment on the constitutional validity of aadhaar. Authenticate tax filings through aadhaar card and pan card linking. The income tax department has extended the last date to link aadhar card with pan card to 31st december 2019.

Home aadhar card link to pan.

Therefore, if you are holding two pan cards, you should link the correct pan card with aadhar and surrender the other one. I have only year of birth in aadhaar card. Linking your aadhar to pan. Authenticate tax filings through aadhaar card and pan card linking. Pan card and aadhaar card are both extremely important identity proofs that are essential for. Therefore, if you pay tax, then it has become very important for you to link aadhar card to pan card. Open an instant bank account with aadhar pan linking. Link your aadhar card number, pan card to epf account at iwu.epfindia.gov.in in this sophisticated world it is always essential to link up all your accounts for easy access and moreover to reduce the loss of fraud cases. Linking up all your accounts will be very safe and also easy for you access from. This law was also upheld by the supreme court and pan aadhar link has become essential. First open your pc,laptop or mobile. Enter all the personal details and select the benefit type from the options menu and select ration. Benefits of linking aadhar with pan:

The government apart from linking the aadhar card with pan numbers has also made it compulsory to have an aadhar card for the new tax payers in order to obtain a pan number. Authenticate tax filings through aadhaar card and pan card linking. Pan aadhar link comes with certain benefits for the taxpayers. Linking up all your accounts will be very safe and also easy for you access from. Therefore, if you pay tax, then it has become very important for you to link aadhar card to pan card.

I have only year of birth in aadhaar card.

If you go directly to the pf office and submit the 15g pf form, they will manually clear it. Therefore, if you are holding two pan cards, you should link the correct pan card with aadhar and surrender the other one. Aadhar card contains a unique sixteen digit number. Compulsory to provide both aadhaar & pan crad how to link aadhaar number to pan card ? Procedure for linking aadhar card to ration card through government portal or offline or sms mode. Simply send an sms to 567678 or 56161 in the following format uidpan 111133333322 aaaaabbbbb. This makes it very convenient for the govt to stay track of those transactions. Enter all the personal details and select the benefit type from the options menu and select ration. Authenticate tax filings through aadhaar card and pan card linking. Once uidai verifies the data, the linking gets confirmed. Open an instant bank account with aadhar pan linking. Linking up all your accounts will be very safe and also easy for you access from. Only after linking aadhar card to pan card, you can complete the process of tax returns.

Komentar

Posting Komentar